Changes in CareShield Life & MediSave: Assessing the Business Impact for healthcare providers in Singapore

By Medinex Team

Nov 14, 2025

By Medinex Team

Table of Contents

ToggleOn Aug 27 this year, MOH accepted the CareShield Life Council’s recommendations on improvements to CareShield Life to ensure long-term care remains affordable for Singaporeans and Permanent residents. Similarly, several CPF-related announcements were also made during the FY2025 Budget Statement and the Committee of Supply (COS) debates in Parliament. In this article, we will review some of these important changes and highlight potential impacts on healthcare service providers in Singapore.

1. Understanding the CareShield Life

Enhancements & the Potential Business Impact

CARESHIELD LIFE

CARESHIELD LIFE

CareShield Life Enhancements

(Jan 2026 onwards)

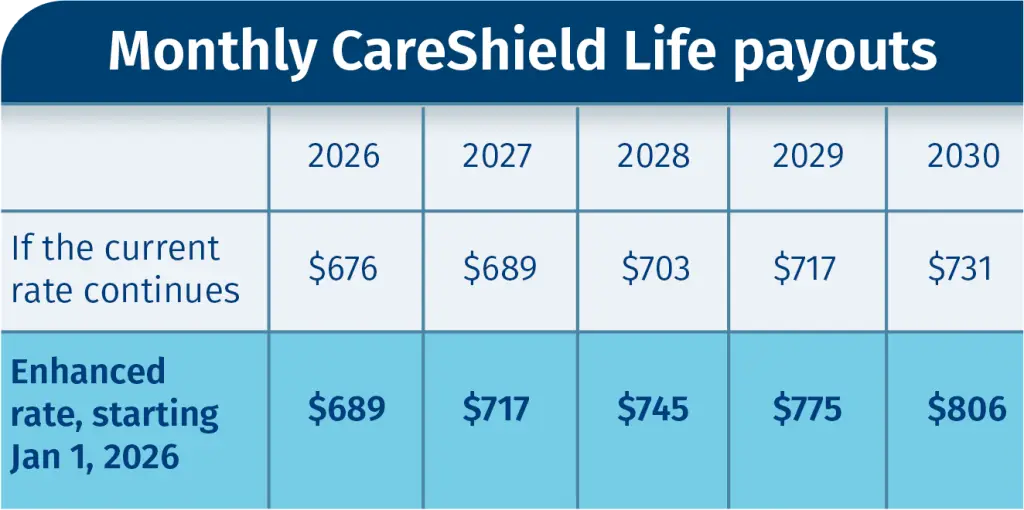

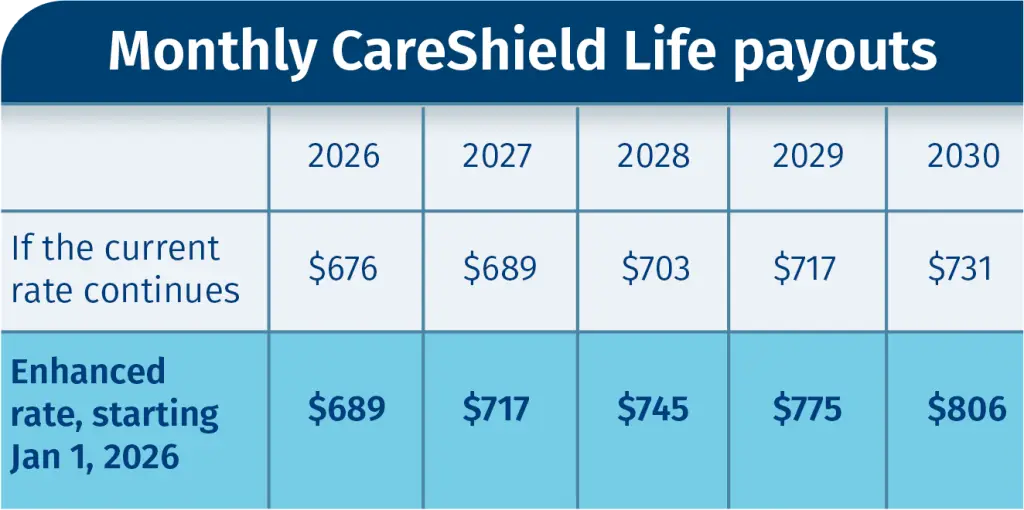

1. Doubled Monthly Payout Growth

Monthly CareShield Life payout growth rate will increase from 2% to 4% annually (2026–2030). As such, the claim in 2030 yields S$806/month, up from S$731/month under the old rate. Refer to the table below

for details.

Business Insight For

Healthcare Providers

1. Increased Service Demand

The higher monthly payout was introduced to cushion the rising cost

of long-term care for Singaporeans with severe disabilities. However, even after the increment, the monthly payout covers only a fraction of the monthly cost of long-term care. When considered with the increase in Home Caregiving Grant which will take effect from Apr 2026 onwards, the combined financial incentive may lead to an increase in demand for care services such as nursing homes and community rehabilitation.

CareShield Life Enhancements

(Jan 2026 onwards)

Business Insight For

Healthcare Providers

1. Doubled Monthly Payout Growth

Monthly CareShield Life payout growth rate will increase from 2% to 4% annually (2026–2030). As such, the claim in 2030 yields S$806/month, up from S$731/month under the old rate. Refer to the table below

for details.

1. Increased Service Demand

The higher monthly payout was introduced to cushion the rising cost

of long-term care for Singaporeans with severe disabilities. However,

even after the increment, the monthly payout covers only a

fraction of the monthly cost of long-term care. When considered

with the increase in Home Caregiving Grant which will take effect from Apr 2026 onwards, the combined financial incentive may lead to an

increase in demand for care services such as nursing homes and

community rehabilitation.

2. Enhanced Long-Term Care Subsidies

Long-term care service subsidies will increase progressively from 2026 onwards by up to 15 percentage points for frail and ill seniors who require long-term care for citizens born after 1969, and up to 20 percentage points for residential long-term care services for citizens born in 1969 or

earlier. Per Capita Household Income (PCHI) eligibility threshold will also be raised from S$3,600 to S$4,800.

2. Demand for Subsidised Care Grows

A broader swathe of citizens who are elderly will now be eligible for

greater subsidies. Long-term care services may see an increase in

demand.

Sources:

https://www.straitstimes.com/singapore/health/careshield-life-to-offer-higher-payouts-from-2026-570m-of-subsidies-to-offset-premium-increases

https://secure.fundsupermart.com/fsmone/article/rcms341780/careshield-life-2026-heres-whats-changing-and-what-it-means-for-you

https://www.straitstimes.com/singapore/budget-2025-more-help-for-seniors-including-those-living-in-private-property

https://www.aic.sg/financial-assistance/home-caregiving-grant-hcg/

2. Understanding the Changes to CPF MediSave And The Implications

Various CPF-related changes were announced this year. We want to focus primarily on the expansion of MediSave withdrawal limits for outpatient care, chronic and higher-cost treatments to understand how they may directly affect Specialist Outpatient Clinics (SOCs), polyclinics, GP clinics, and dental service providers.

MEDISAVE

MEDISAVE

MediSave Enhancement

(Jan 2026 onwards)

1. Higher Outpatient Scan Limits

MediSave annual limit for outpatient scans (e.g., MRI/CT) will double from S$300 to S$600).

2. Increased Flexi-MediSave Limits

Annual withdrawal limit for Flexi-MediSave (for seniors aged 60+) increased from S$300 to S$400 (from Oct 2025).

3. Expanded Dental Coverage

Flexi-MediSave use will be extended to include root canal treatments and permanent crowns at CHAS dental clinics and public institutions (from mid-2026).

4. Extended Use of MediSave for Fertility Preservation

From June 2026, the use of MediSave will be extended to cover the surgical costs of embryo freezing, egg freezing and ovarian tissue freezing. The use of MediSave will also be extended to cover the pre- and post-procedure costs of embryo freezing and ovarian tissue freezing.

Business Insight For

Healthcare Providers

1. Increased Utilisation of Imaging Services

Greater affordability of high-cost diagnostic services may lead to an increase in patient volume for SOCs and imaging centres. Providers must be prepared to handle this surge in demand.

2. Boost for Elder-Focused Outpatient Care

This directly reduces the fifinancial burden forseniors at GPs, polyclinics, and SOCs.

Providers serving a higher proportion of elderly patients (especially those under CHAS) may experience a bump in service utilisation and MediSave transactions.

3. Shift in Dental Funding

For private dental clinics under CHAS, this

change allows the use of MediSave for more complex, high-value procedures. Your customer-facing staff needs to be familiar with the new limits and eligible procedures so as to facilitate claims and provide proper advice to patients.

4. Increased Demand For Fertility Preservation Services

This significantly improves the affordability of fertility preservation procedures and may increase demand for fertility preservation services.

MediSave Enhancement

(Jan 2026 onwards)

Business Insight For

Healthcare Providers

1. Higher Outpatient Scan Limits

MediSave annual limit for outpatient scans (e.g., MRI/CT) will double from S$300 to S$600).

1. Increased Utilisation of Imaging Services

Greater affordability of high-cost diagnostic services may lead to an increase in patient volume for SOCs and imaging centres. Providers must be prepared to handle this surge in demand.

2. Increased Flexi-MediSave Limits

Annual withdrawal limit for Flexi-MediSave (for seniors aged 60+) increased from S$300 to S$400 (from Oct 2025).

2. Boost for Elder-Focused Outpatient Care

This directly reduces the fifinancial burden for seniors at GPs, polyclinics, and SOCs. Providers serving a higher proportion of elderly patients (especially those under CHAS) may experience a bump in service utilisation and MediSave transactions.

3. Expanded Dental Coverage

Flexi-MediSave use will be extended to include root canal treatments and permanent crowns at CHAS dental clinics and public institutions (from mid-2026).

3. Shift in Dental Funding

For private dental clinics under CHAS, this change allows the use of MediSave for more complex, high-value procedures. Your customer-facing staff needs to be familiar with the new limits and eligible procedures so as to facilitate claims and provide proper advice to patients.

4. Extended Use of MediSave for Fertility Preservation

From June 2026, the use of MediSave will be extended to cover the surgical costs of embryo freezing, egg freezing and ovarian tissue freezing. The use of MediSave will also be extended to cover the pre- and post-procedure costs of embryo freezing and ovarian tissue freezing.

4. Increased Demand For Fertility Preservation Services

This significantly improves the affordability of fertility preservation procedures and may increase demand for fertility preservation services.

Depending on your area of specialisation, these policy changes may impact your business and it is important that you prepare for them in advance. We hope you find this article insightful and if you need further consultation, do get in touch with us by sending us an email at contact@medinex.com.sg.

MEDINEX Limited is an established one-stop consultancy service with more than 20 years of experience in incorporation, accounting & tax services, HR and business consultancy specialising in helping healthcare service providers.